Insurance

Let us help you to ensure you’re covered for life’s unforeseen events.

Risk management is the term we use to describe the need to have adequate personal insurances in place. This component of the plan can be tailored to meet all contingencies and unforseen circumstances. Our aim is to ensure that you have the appropriate level and type of cover in place at all times, and that it is structured in a tax effective manner.

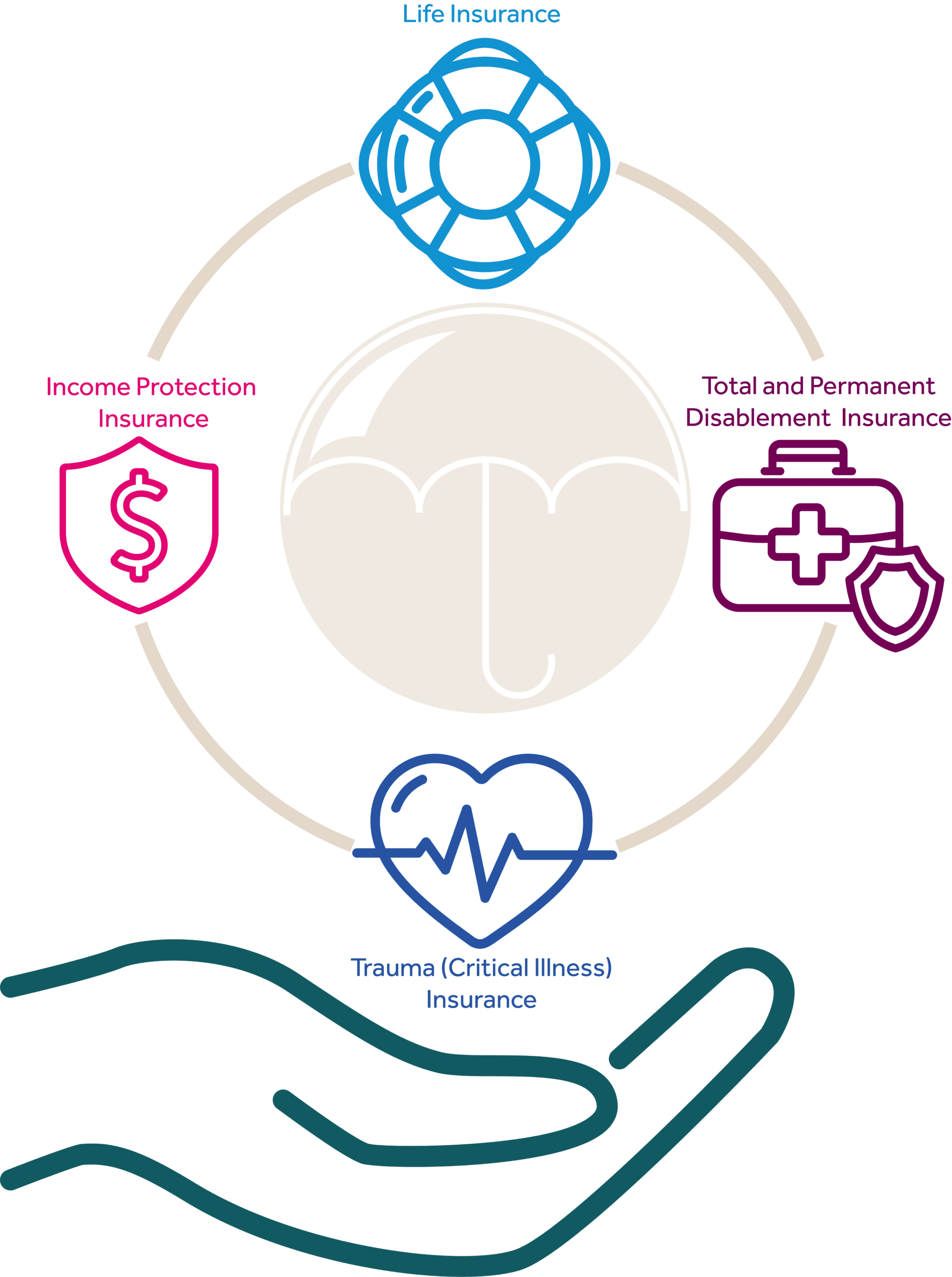

Our insurance services:

Life Insurance

Life insurance provides a lump sum amount paid to your beneficiary on the death of the insured which can be used to pay out existing debts, provide an ongoing income to surviving family members, and/or pay for funeral costs.

Total and Permanent Disablement Insurance

TPD insurance provides a lump sum amount paid to the insured should they become totally and permanently disabled which can be used to pay out existing debts, provide an ongoing income, make home modifications, and/or pay medical costs in case of a permanent disability.

Income Protection Insurance

Income Protection provides you with a regular source of income should you be unable to work for a period due to sickness or injury. You can generally insure for up to 75% of your earned income.

Trauma (critical illness) Insurance, including Child Trauma

Trauma insurance provides a lump sum amount paid to the insured should you suffer one of the specified serious medical conditions (i.e. heart attack, stroke, brain tumours, liver failure or cancer). This payment can be used to pay out debts, provide an ongoing income, and/or pay medical costs.

Having the right insurance in place means you can have peace of mind that your loved ones are covered.

How we calculate insurance cover to meet your needs

- What type of insurance? what are the types of insurances that you need to have in place in order to protect your loved ones in the event of your death, disability, sickness or injury?

- How much cover is enough? what is the level of cover that you need in order to ensure that your financial and personal needs and objectives are not compromised?

- What ownership structure is best? Which structure will best to hold your life cover in to suit you from a cash flow, tax and accessibility point of view.

- Which provider? What are the best quality products on the market from a cost & policy definition perspective, to ensure you are maximising your success in the event of a claim?

Ongoing Insurance Service

After the insurance is put into place we will actively review this on an annual basis to check in to see if your insurance is adequate for your current situation, needs and objectives.

- A cash flow driven analysis to confirm you have the right level of cover each year. Our goal in the long term is to gradually reduce your exposure to insurance (and reduce your premium costs) as your asset position grows

- A review of your policies against the market to ensure that they are still competitive from a cost and quality of definitions perspective.

- Any changes to the Insurance industry that you should be aware of.

- A review of your ownership structures to confirm that you can generate the optimal tax deduction for premium (where possible) while also being cognisant of the tax treatment of any benefit payable in the event of claim.

Any amendments to the policy that will improve your situation (changes to sum insured without underwriting, agreed v indemnity, level v stepped, ancillary benefits that can reduce premium and/or lifestyle costs over time etc).

We work in conjunction with your overall financial planning goals and we want you to first and foremost protect your assets and provide for your loved ones as well as preserving your hard earned capital.

Our Specialist Advisers

Interested in talking to us?

Get in touch below for a free initial consultation with a Nexia Financial Adviser to discuss your cash flow situation and start planning for your financial goals today.